Building a Predictable Revenue Engine from the Ground Up

Executive Summary

For MedTech startups navigating the complexities of commercialization, an accurate sales forecast is not just a numbers game; it’s a strategic imperative. Sales forecasts fuel investor confidence, inform staffing decisions, shape marketing strategies, and ultimately, dictate the pace of market entry. This whitepaper offers a structured approach to sales forecasting tailored to emerging medical technology companies, focusing on the key drivers, decision points, and process dynamics that shape successful go-to-market plans.

1. Start with the Right Questions

Before you input a single number into a model, consider the following foundational questions:

2. The Process Yield Funnel: Define Your Commercial Steps

The model in your spreadsheet uses a Yield-Based Sales Funnel that breaks down the customer acquisition process into conversion stages. This gives startups clarity on where pipeline attrition happens — and how much activity is required to hit revenue targets.

Sample Funnel for Existing Customers (Upsell):

| Step | Description | Example Yield |

| Campaign Target | Total contacts engaged | 100% |

| Decision Maker Reached | Contacts reached | 60% |

| Opportunity Identified | Qualified interest | 50% |

| Product Demo | Engaged leads | 75% |

| Sale | Closed deals | 30% |

This example results in a 6.75% overall conversion rate (0.6 × 0.5 × 0.75 × 0.3), meaning you’ll need to start with ~15 prospects for every sale

What If You Don’t Have Benchmarks?

Many MedTech startups lack historical data early on. In this case, apply the 10:3:1 Rule:

* For every 10 people you talk to, 3 will be interested, and 1 will buy.

This rule of thumb is a reliable proxy to model early activity until actual conversion metrics emerge. It equates to a 10% close rate on total outreach.

Application Example:

If your goal is 100 new customers, then:

Use this rule to estimate:

3. Account for Ramp-Up: Reality vs. Optimism

One of the most overlooked aspects in startup sales forecasts is the time lag between launch and scale. Your model smartly includes:

This reflects real-world adoption patterns, particularly in healthcare, where provider trust, procurement cycles, and clinical validation all cause friction.

Recommendation: Use a conservative ramp profile, and validate with similar MedTech analogs if possible. Over-forecasting Month 1 revenue is a rookie mistake.

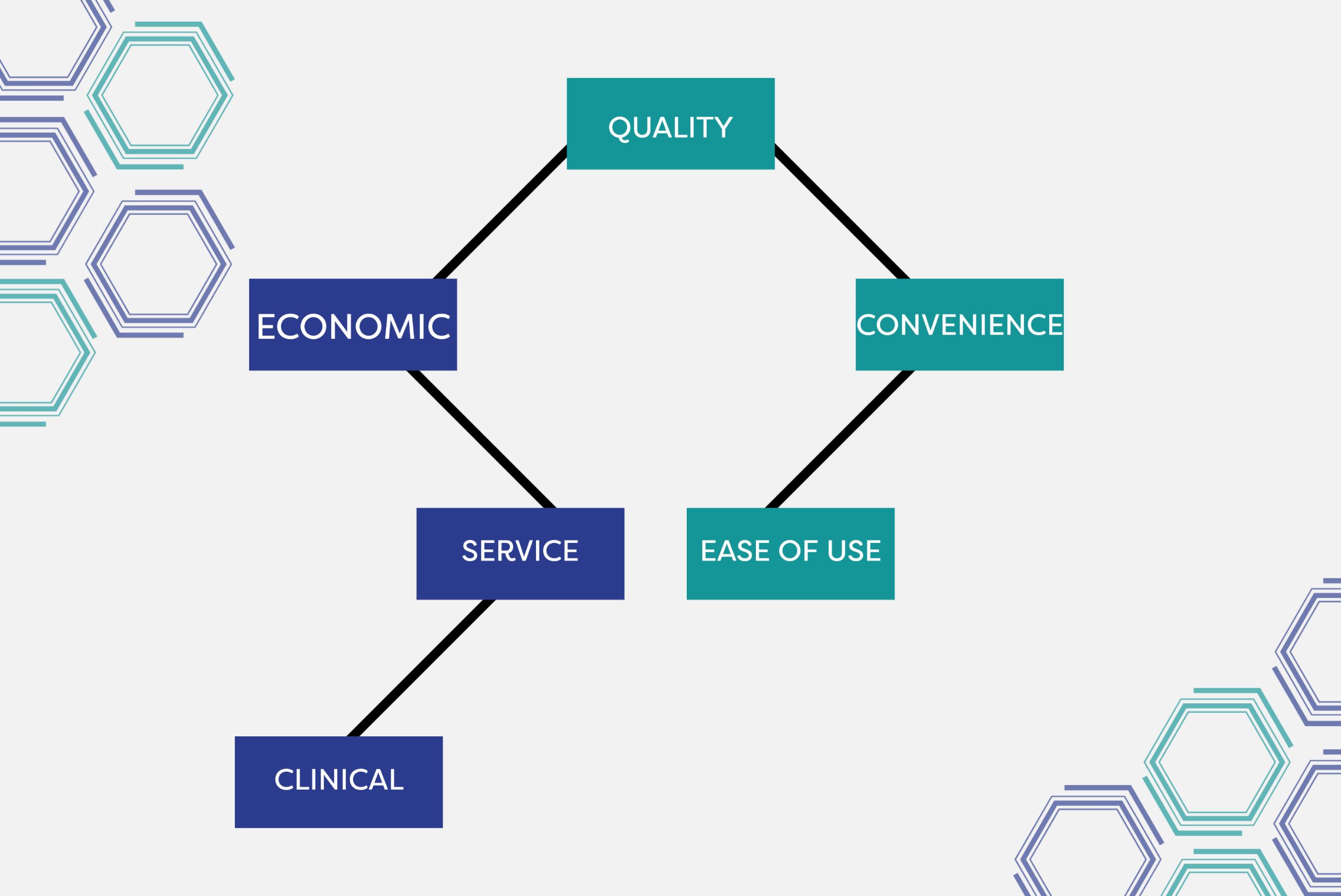

4. Understand Revenue Sources

MedTech companies typically derive revenue from:

Your model includes average order value, monthly value per customer, and projected upsell impact (e.g., 10%). Use industry benchmarks but validate with pilot data or early customers when possible.

5. Staffing and Capacity Assumptions

Your ability to reach, convert, and retain customers depends on team capacity. Use the following logic:

Pro Tip: Forecast sales and support team growth in sync with your revenue ramp. Overhiring too early kills runway. Underhiring bottlenecks growth.

6. KPIs to Track and Refine

Every forecast should come with a feedback loop:

Conclusion

Sales forecasting for MedTech startups is not just about math. It’s about thinking critically through your commercial assumptions, mapping the buyer journey, and designing a funnel that aligns with real market behavior. The included model offers a robust foundation, but your ongoing discipline in testing, learning, and adjusting is what will ultimately ensure success.